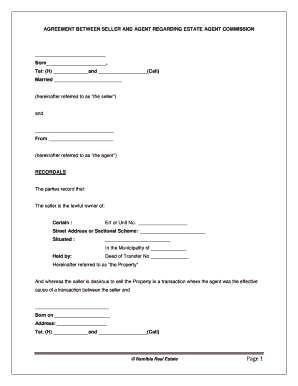

CA Standard Broker Fee Agreement free printable template

Show details

STANDARD BROKER FEE AGREEMENT Pursuant to California Insurance Code Section 1623 1. The parties to this agreement are (CUSTOMER) AND, California Department of Insurance License Number (BROKER”).

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign insurance broker fee agreement template form

Edit your broker fee agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your broker agreement template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit broker fee disclosure form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pdffiller form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

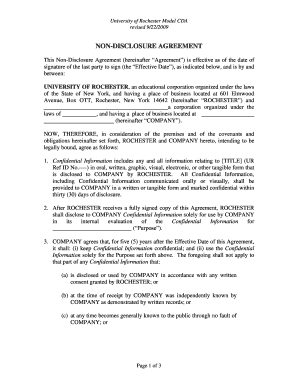

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

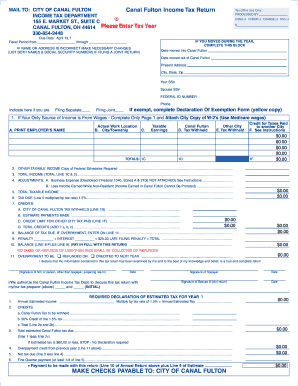

How to fill out commercial broker fee agreement form

How to fill out CA Standard Broker Fee Agreement

01

Begin by downloading the CA Standard Broker Fee Agreement form from a reliable legal resource or your brokerage's website.

02

Read the instructions carefully to understand the requirements of the agreement.

03

Fill in the date at the top of the document.

04

Enter the broker's name and the brokerage firm details accurately.

05

Provide the client's full name and contact information.

06

Clearly state the services being provided by the broker.

07

Specify the fee structure, detailing any flat fees, percentage-based commissions, or other payment arrangements.

08

Include any additional terms and conditions relevant to the agreement.

09

Review the document for any inaccuracies or missing information.

10

Both parties should sign and date the agreement where indicated.

Who needs CA Standard Broker Fee Agreement?

01

Real estate agents and brokers who facilitate property transactions.

02

Clients looking to engage brokers for property buying, selling, or leasing.

03

Real estate professionals seeking to formalize their fee arrangements with clients.

Fill

enter the broker's name and the brokerage firm details accurately undefined

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my broker contract template directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign standard brokerage forms for compliance download and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I sign the broker fee agreement pdf electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your broker fee in minutes.

How do I complete how to fill out ca their fee arrangements with clients on an Android device?

Use the pdfFiller app for Android to finish your broker commission agreement. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is CA Standard Broker Fee Agreement?

The CA Standard Broker Fee Agreement is a legal document used in California to outline the terms and conditions under which a broker earns a fee for their services in facilitating a transaction, typically in real estate or financial dealings.

Who is required to file CA Standard Broker Fee Agreement?

Real estate brokers and agents who are involved in a transaction where a fee is earned or shared must file the CA Standard Broker Fee Agreement to ensure compliance with state regulations.

How to fill out CA Standard Broker Fee Agreement?

To fill out the CA Standard Broker Fee Agreement, you need to provide details such as the parties involved, the specific services to be provided by the broker, the agreed-upon fee structure, and any relevant conditions or timelines.

What is the purpose of CA Standard Broker Fee Agreement?

The purpose of the CA Standard Broker Fee Agreement is to clearly define the financial arrangement between the broker and the client, ensuring transparency, preventing disputes, and complying with legal requirements.

What information must be reported on CA Standard Broker Fee Agreement?

The CA Standard Broker Fee Agreement must report information including the broker's name and contact information, the client's name, the description of services to be provided, the fee percentage or amount, payment terms, and any additional conditions or obligations.

Fill out your CA Standard Broker Fee Agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Where Can I Download Standard Brokerage Forms For Compliance is not the form you're looking for?Search for another form here.

Keywords relevant to compensation agreement between brokers

Related to brokerage agreement

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.